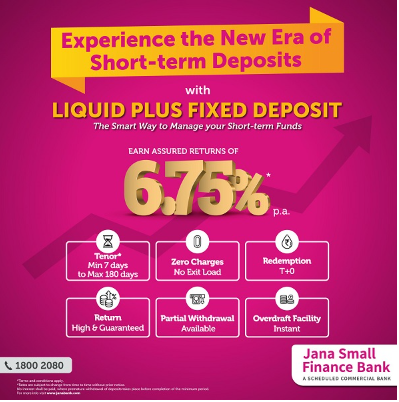

23rd Sept 2024 Bangalore, Karnataka, India Jana Small Finance Bank, one of India’s leading small finance banks, today announced the launch of a comprehensive solution “Liquid Plus” Fixed Deposit with an attractive interest rate of 6.75% p.a. for tenures ranging from 7 to 180 days. The rate is applicable for the minimum deposit amount of INR 10 Lakhs for retail deposits up to INR 3 Crores and above INR 3 Crores to INR 200 Crores for bulk deposits per customer. The liquid plus fixed deposit makes short-term deployment of funds extremely easy and attractive with higher returns. The Bank has taken this step based on the feedback from customers seeking placement of short-term funds.

“Liquid Plus” is designed to cater to the needs of individuals, high-net-worth individuals (HNIs) and corporates seeking short term investment options with safety, liquidity and assured returns. Apart from offering high interest rates this solution also offers innovative features like T+0 (same day) redemption, availability of partial withdrawal feature and Instant Overdraft facility as required.

Notably, there are no pre-maturity redemption charges i.e., no exit load, making it a highly flexible and beneficial fixed deposit investment option.

Speaking on this development Mr. Ajay Kanwal, Managing Director and Chief Executive Officer, Jana Small Finance Bank said, “Our aim to serve a new segment of customers who will look at short-term Bank deposits meeting their needs of managing surplus money.”